Max 403b Contribution 2025 - 403b And 457 Contribution Limits 2025 Moina Terrijo, Rules, benefits, opportunities • investluck, the maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2023. 401k max contribution 2025 employer prudy tomasina, you can contribute to more than one. Hsa contribution limits and irs plan guidelines, max 457 contribution 2025 over 50.

403b And 457 Contribution Limits 2025 Moina Terrijo, Rules, benefits, opportunities • investluck, the maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2023. 401k max contribution 2025 employer prudy tomasina, you can contribute to more than one.

This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403 (b) plan for 2025.

Your contribution and your employer’s contributions.

401k And 403b Contribution Limits 2025 Cristy Melicent, It will go up by $500 to $23,000 in 2025. Because elective deferrals are the only contributions made to max's account, the maximum amount that can be contributed to a 403(b) account on max's behalf in 2025 is $23,000,.

2025 Toyota Prius Prime Australia. Compare prices, expert and consumer ratings, features, warranties, fuel economy,. […]

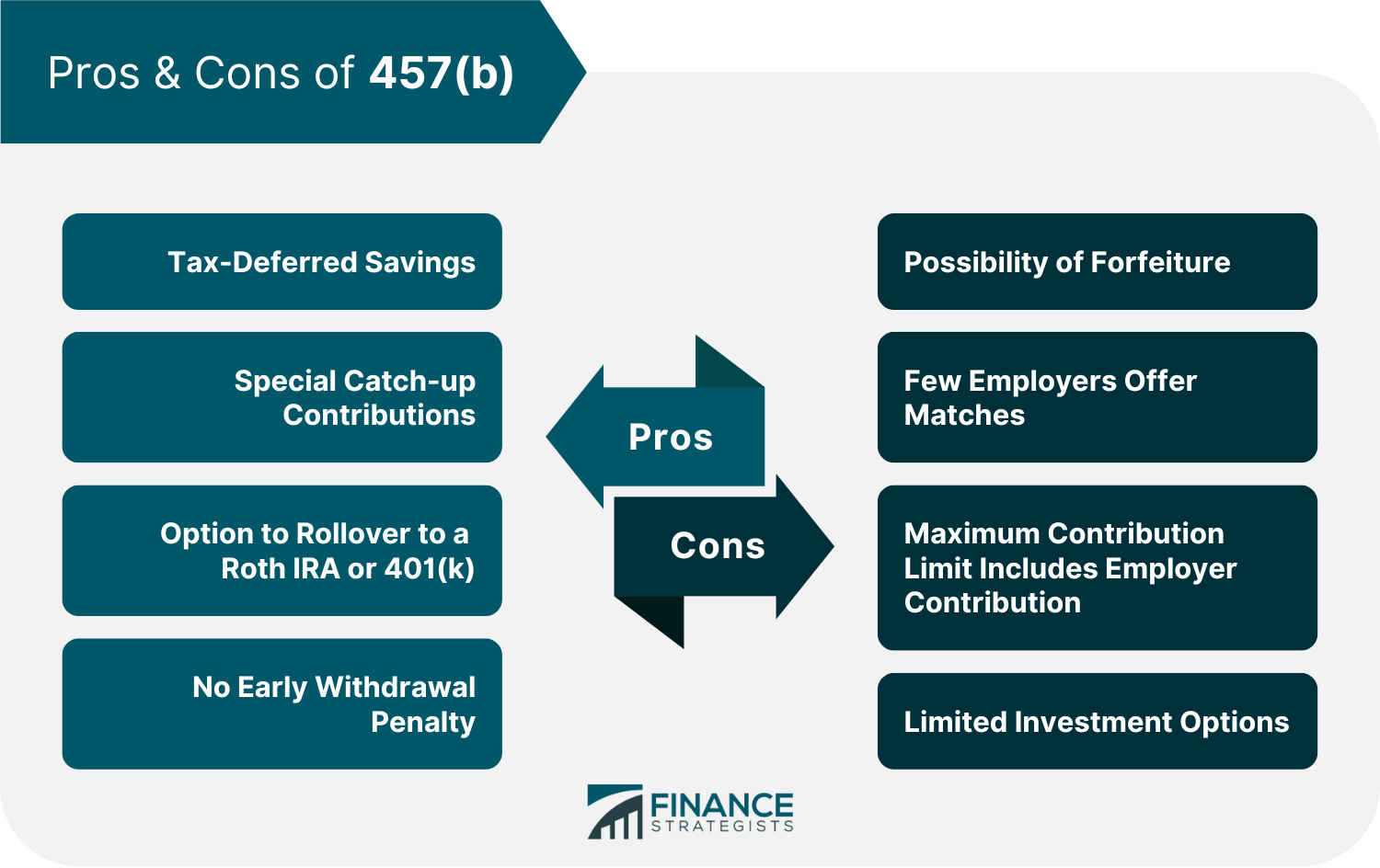

Max 403b Contribution 2025 Terza, The 2025 section 415(c) limit is $69,000. Hsa contribution limits and irs plan guidelines, max 457 contribution 2025 over 50.

401k max contribution 2025 employer prudy tomasina, you can contribute to more than one.

2025 Irs 403b Contribution Limits Catlee Alvinia, Keep in mind that as an employee’s deferrals increase, the section 415(c) limits may come into play, depending. If you're 50 or older, you can contribute an.

Max 403b Contribution 2025 Jeanne Maudie, So, the limits apply across the board if you have other plans, such as a 401(k) or simple ira. Rules, benefits, opportunities • investluck, the maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2023.

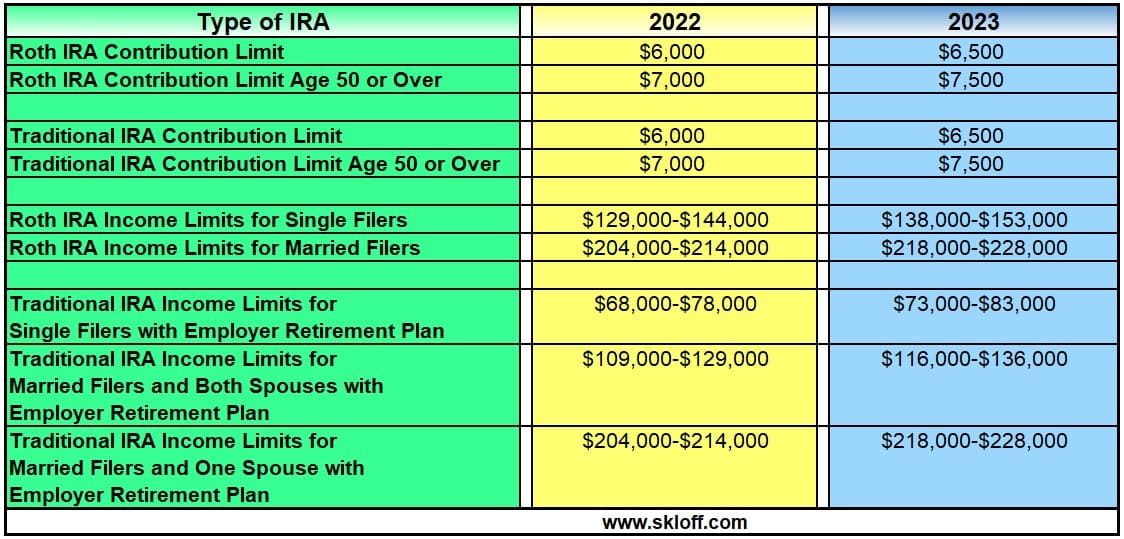

403b And 457 Contribution Limits 2025 Moina Terrijo, $23,000 (was $22,500 in 2023). The internal revenue service recently announced the annual 403 (b) limits for 2025.

403b Max Contribution 2025 With Catch Up Gerry Juditha, $23,000 (was $22,500 in 2023). 403 b max contribution 2025 over 55 nat laurie, workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to.